PayPal

Description of PayPal

PayPal is a widely used mobile application that facilitates secure online and in-store transactions, money transfers, and shopping rewards. This app is available for the Android platform and can be easily downloaded for users looking to manage their finances effectively. PayPal is recognized for its ability to streamline payments and provide users with various financial services.

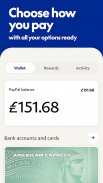

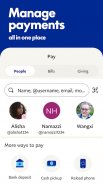

Users can conveniently send and receive money using PayPal, making it an ideal choice for transactions with friends and family. The app supports operations in over 120 countries, allowing users to connect with a broader network. Sending money within the United States is free of charge when using a bank account or PayPal balance as the funding source, which enhances its appeal for personal transactions.

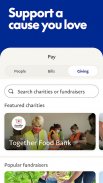

In addition to peer-to-peer transfers, PayPal offers a feature that allows users to save cash back offers from various brands. Once registered, users can access these offers directly in the app. The rewards are automatically applied at checkout, making the process seamless. Eligible items can earn users cash back, which can be redeemed for cash or other options, thus incentivizing users to shop with their favorite brands.

The PayPal debit card is another integral feature of the app. Users can request the card directly through the app without undergoing a credit check. This card enables users to make purchases wherever Mastercard is accepted, using their PayPal balance. Additionally, it offers the opportunity to earn 5% cash back on a selected category each month, providing an extra layer of financial benefit for users who frequently shop.

For users managing multiple purchases, PayPal includes a tracking feature that allows them to view their orders and delivery statuses directly from the app. By linking their Gmail or Outlook accounts, users can receive live updates on their package deliveries. This tracking functionality enhances the shopping experience, as users can monitor their purchases even if they did not use PayPal for payment.

The app also offers a "Pay in 4" feature, which allows users to split their purchases into four interest-free payments. This service is available for transactions ranging from $30 to $1,500 and does not incur any late fees or impact the user's credit score. Users can manage their payment schedules within the app, providing a flexible option for financing everyday purchases.

PayPal Savings is another feature designed to help users grow their money. By rolling funds into a PayPal Savings account, users can earn a competitive annual percentage yield (APY). The app facilitates easy management of the savings account, allowing users to transfer money, set individual savings goals, and monitor their progress over time. This feature emphasizes PayPal's commitment to providing comprehensive financial services beyond simple transactions.

Security is a major focus for PayPal, and the app utilizes advanced security measures to protect users' financial information during transactions. The company employs encryption and fraud detection technologies to ensure that users can shop and send money with confidence. This commitment to security makes PayPal a trusted option for millions of users worldwide.

The app's interface is designed for user convenience, with a straightforward layout that allows for easy navigation. Users can quickly access their transactions, balance, and other features without unnecessary complexity. This intuitive design helps users manage their finances efficiently and reduces the learning curve for new users.

PayPal continues to evolve by introducing new features and improving existing services. The ongoing updates reflect the company’s dedication to enhancing user experience and adapting to the changing landscape of digital finance. As more consumers shift towards online shopping and digital payments, PayPal remains a key player in the financial technology sector.

With its diverse features, including secure money transfers, cash back offers, a debit card with rewards, package tracking, flexible payment options, and savings accounts, PayPal caters to a wide range of financial needs. This versatility makes it suitable for various users, from casual shoppers to those looking to manage their finances more comprehensively.

By downloading PayPal, users gain access to a powerful tool that simplifies financial transactions and provides opportunities for savings and rewards. The app stands out for its reliability and user-friendly design, ensuring that individuals can conduct their financial activities with ease and security.

PayPal offers a comprehensive suite of features that support users in managing their money effectively and securely. With its focus on user experience and financial growth, it continues to be an essential application for many individuals navigating the world of digital finance.